Fundraising in China: what do Chinese investors look for?

- Posted by mr_pavel

- On January 9, 2019

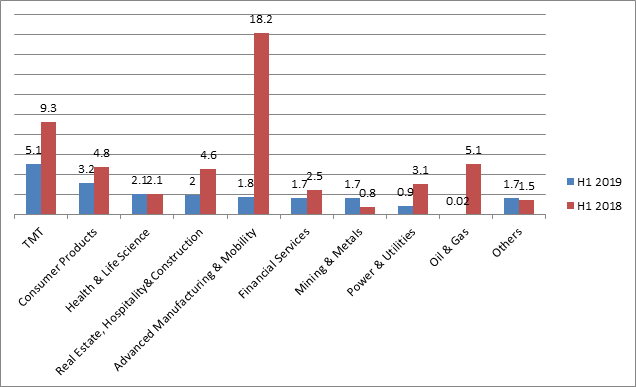

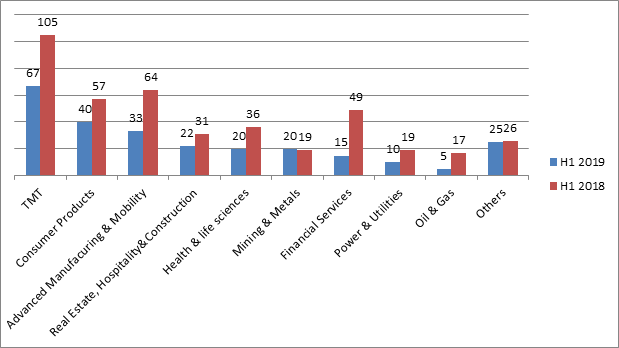

In H1 2019, the value of announced China overseas M&As amounted to US$20.0 billion, down nearly 60% YoY, the lowest of the past seven years, while the number of announced M&As dropped nearly 40% YoY to 257.

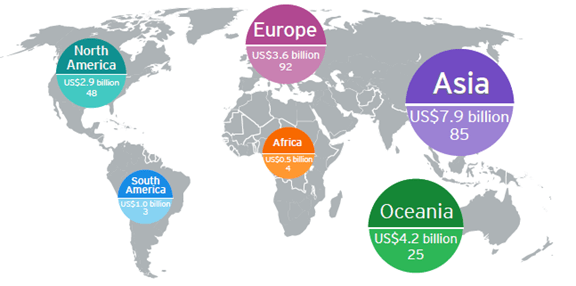

As China’s industrial structural adjustment deepens, sectors that support structural adjustment, reform and upgrading are becoming increasingly favored among Chinese investors for overseas M&As. As a result, Chinese companies are moving upward in the global value chain. It is expected that high-tech and high value-added emerging sectors, high-end service industries and the consumer products sector will continue to be the focus of overseas M&A activities. Meanwhile, Overseas M&As in Asia-Pacific increased despite contracting trends, making the region the top destination for Chinese investors.

Announced China overseas M&As deal value by sector, H1 2019 and H1 2018 (US$ billion)

Announced China overseas M&As deal volume by sector, H1 2019 and H1 2018

Announced China overseas M&A deal value (US$ billion) and volume by destination, H1 2019

Reference:

China Go Abroad (9th issue), Ernst & Young, How will Chinese enterprises navigate new challenges when “going abroad” under the new global trade landscape?, October 2019, https://www.ey.com/Publication/vwLUAssets/ey-china-overseas-investment-report-issue-9-en/$FILE/ey-china-overseas-investment-report-issue-9-en.pdf